EV Battery Types 2025: What Tesla, BYD, Xiaomi & Others Are Using

Published on July 8, 2025 | by EV Battery School

Introduction

What Type of Batteries Do Electric Cars Use? This post will tell you the well know brand BYD to Tesla, Xiaomi, AITO, and NIO. each brand is making strategic battery choices based on performance, safety, cost, and sustainability.

When you’re ready to buy an EV but not sure which brand to choose, it’s better to compare the battery and charging speed of them. We can choose depending on our budget, climate, and daily drive range.

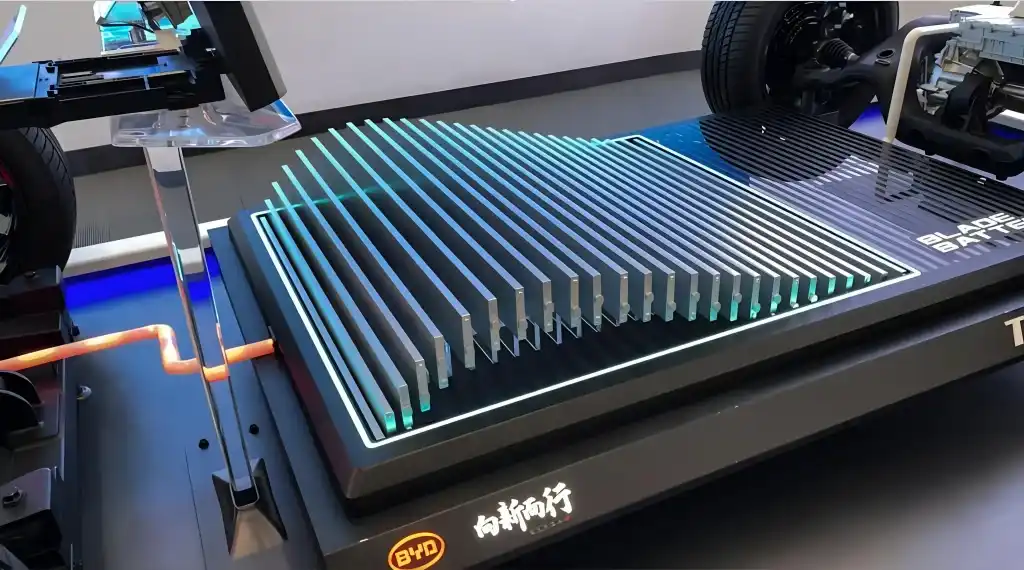

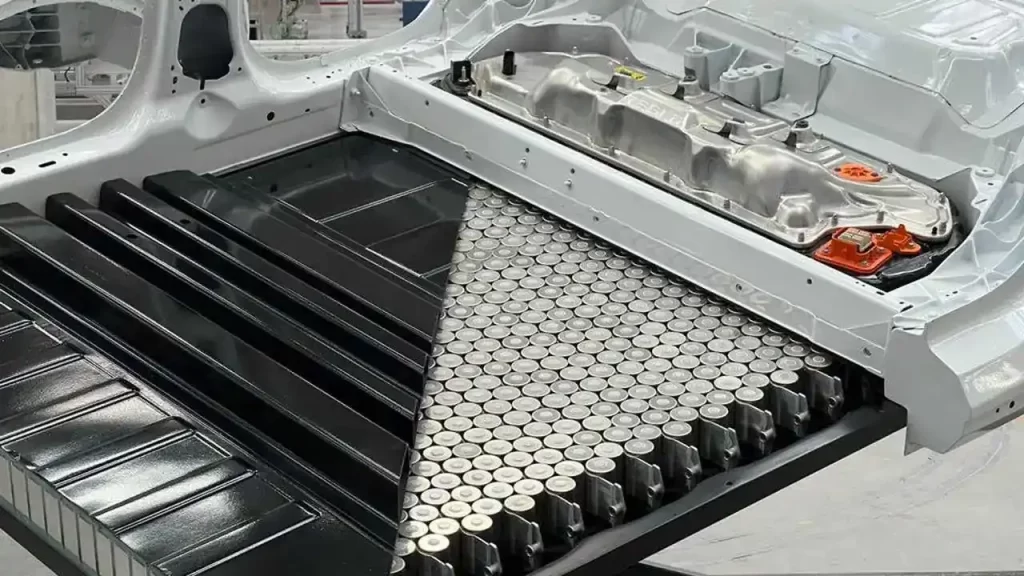

BYD: Blade Battery (LFP)

BYD manufactures its own lithium iron phosphate (LFP) batteries known as Blade Batteries. These are prized for their safety, thermal stability, and long cycle life, making them ideal for daily commuting and fleet applications.

Advantages of BYD Blade Battery:

- Highly resistant to overheating and fire

- Long cycle life exceeding 3,000 cycles

- Excellent structural integrity due to blade form factor

- Lower degradation over time

The Blade Battery uses Lithium Iron Phosphate (LFP) which has undergone standard testing through the Nail penetration test method. In this test a nail is driven through the center of the battery cell until it penetrates to the other side causing a short circuit inside the battery cell. Through this testing, BYD’s Blade Battery has demonstrated higher safety standards compared to Lithium Nickel Manganese Cobalt Oxide and Lithium Nickel Cobalt Aluminum Oxide batteries. Additionally, it also has lower production costs compared to NMC (Lithium Nickel Manganese Cobalt Oxide) battery production costs referenced to the price of nickel as the basis for NMC battery production costs.

Lithium iron phosphate batteries have better performance in collision, low temperature and other environments. They are not prone to explosion and fire, and provide better protection for drivers. In low temperature environments, especially in very cold winters, the battery drive range is longer.

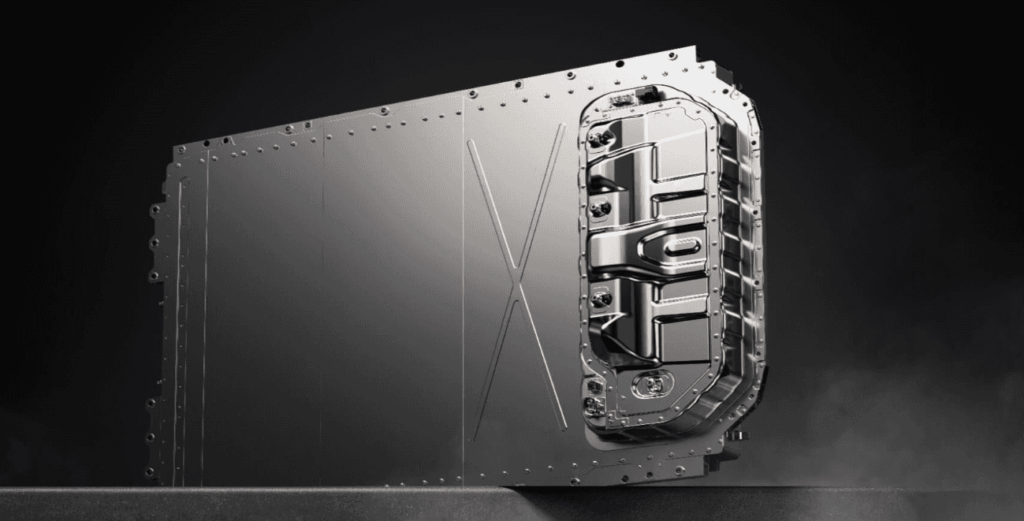

Tesla: Use Mix of LFP, NCA, and 4680 Cells

Tesla uses a mix of battery types depending on the model and market. For instance, its Model 3 and Model Y Standard Range models use LFP batteries from CATL in China, while premium models like the Model S and Model X use NCA batteries from Panasonic. Tesla also produces its proprietary 4680 cells aimed at higher energy density and lower production cost.

Advantages of Tesla’s Battery Strategy:

- 4680 cells offer superior energy density and fast charging

- Flexible sourcing allows cost optimization

- Proven track record in both LFP and NCA chemistries

- Enhanced integration with Tesla’s thermal management system

Tesla will choose different kinds of batteries in different markets, which can help Tesla significantly reduce production costs and expenses. It can quickly win the favor of consumers in different markets and achieve good market results. Therefore, Tesla’s cost performance is relatively high.

Battery innovation and diversity: Tesla is developing advanced battery technologies such as the aluminum-ion battery, which offers up to 30% lower production costs compared to traditional lithium-ion batteries, along with longer range and faster charging. Tesla is also working with different suppliers globally, including Panasonic, CATL (China), and LG Chem (South Korea), allowing it to tailor battery sourcing and technology to local markets.

Production scale and cost control: Tesla’s Gigafactory model allows vertical integration and economies of scale, which reduce manufacturing complexity and costs. Their cell-to-pack design and tableless cell technology further streamline production and improve battery performance, contributing to cost efficiency.

Market adaptation: By choosing different battery types and suppliers in different regions, Tesla can optimize costs and supply chain logistics, enabling faster market penetration and consumer acceptance. This flexibility supports Tesla’s ability to offer competitive pricing and meet local consumer demands effectively.

Future cost reductions: Tesla aims to reduce battery costs by up to 50% through ongoing innovations and production efficiencies, which will further improve their vehicles’ cost performance and affordability.

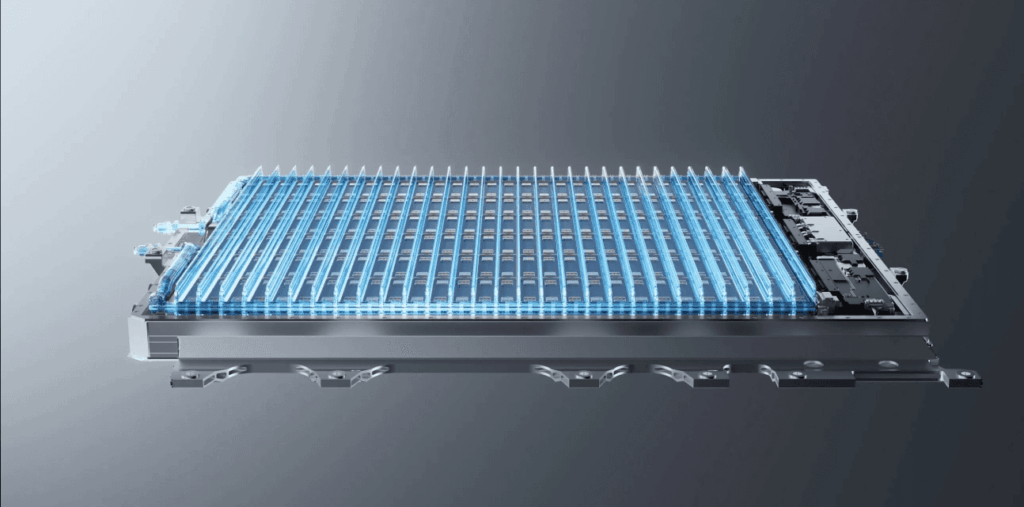

Xiaomi: CATL & BYD Supply Chain

Xiaomi entered the EV space with its SU7 series, using both BYD Blade LFP batteries and CATL’s NMC lithium-ion batteries. This dual-sourcing strategy allows flexibility in balancing performance and affordability.

Advantages of Xiaomi’s Dual Battery Approach:

- Leverages strengths of both NMC (range) and LFP (safety)

- Scalability through partnerships with top battery makers

- Optimized for both performance and cost-sensitive segments

Xiaomi Motors, as an emerging player in the automotive industry, leverages its strong design expertise and extensive mobile phone user base to carve out a unique position in the electric vehicle (EV) market.

Battery Technology and Partnerships

Xiaomi Motors employs relatively mature and reliable battery technologies, ensuring safety, longevity, and performance.

By partnering with advanced battery manufacturers, the company secures high-quality battery packs that optimize cost and efficiency.

These collaborations help Xiaomi keep production costs manageable while maintaining strong vehicle performance, resulting in excellent cost performance.

Targeting Young Consumers

Xiaomi Motors focuses on affordability without compromising on speed, design, and technology, making its EVs particularly attractive to younger demographics.

Positive reviews highlight the vehicles’ balance of performance, style, and affordability, reinforcing Xiaomi Motors as a compelling choice in the EV market.

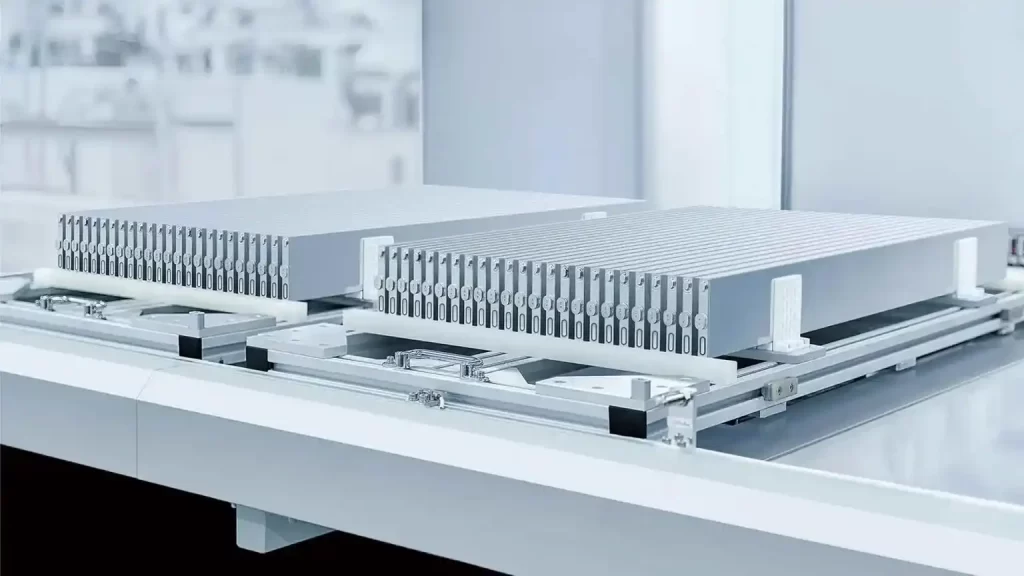

AITO: Partnering with BYD for Blade Batteries

AITO, a brand under Seres, often partners with BYD to equip its electric SUVs with Blade LFP batteries. These batteries enhance thermal safety and are well-suited for family and utility vehicles.

Advantages of AITO’s Blade Battery Integration:

- Robust safety performance in urban and highway driving

- Stable discharge ideal for long-term usage

- Reduced maintenance and high reliability

AITO Automobile (Wenjie) has quickly achieved brand breakthrough and sales growth with a series of innovative measures and precise market positioning.

Cutting-edge battery and battery life technology

Kirin battery support: The new models are fully equipped with CATL Kirin batteries, which have high energy density and high volume utilization, support ultra-long battery life (over 1,000 kilometers), 5-minute hot start and 10-minute fast charging, and improve the actual user experience.

Battery safety and intelligent management: The battery system has cloud-based intelligent management and real-time monitoring of 100+ sensors to ensure safety and life.

Digital marketing and user operations: Accurate communication strategy, with the help of social media and digital platforms, enhance user stickiness and brand influence.

Efficient supply chain and large-scale production

Localized supply chain integration: Deep cooperation with local suppliers to reduce costs and improve response speed.

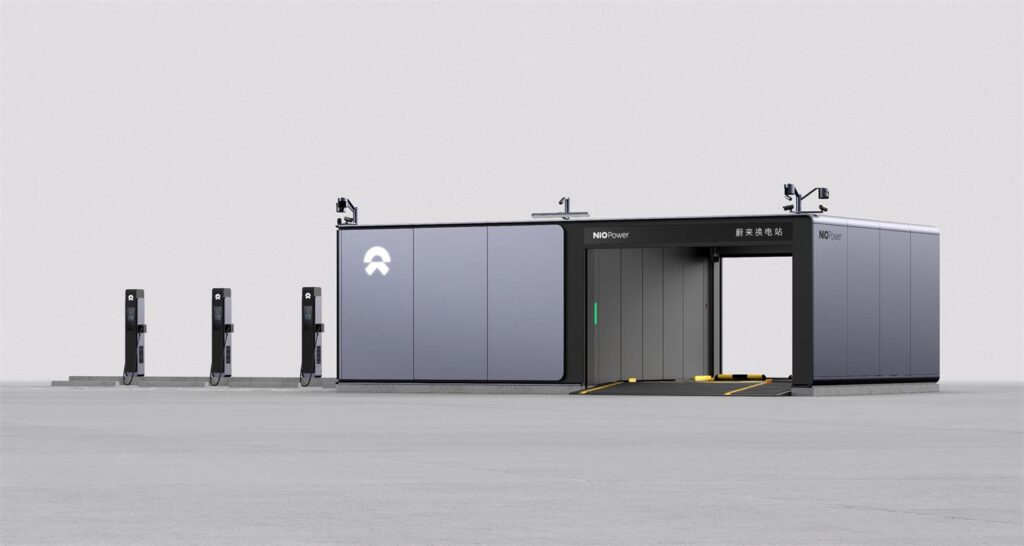

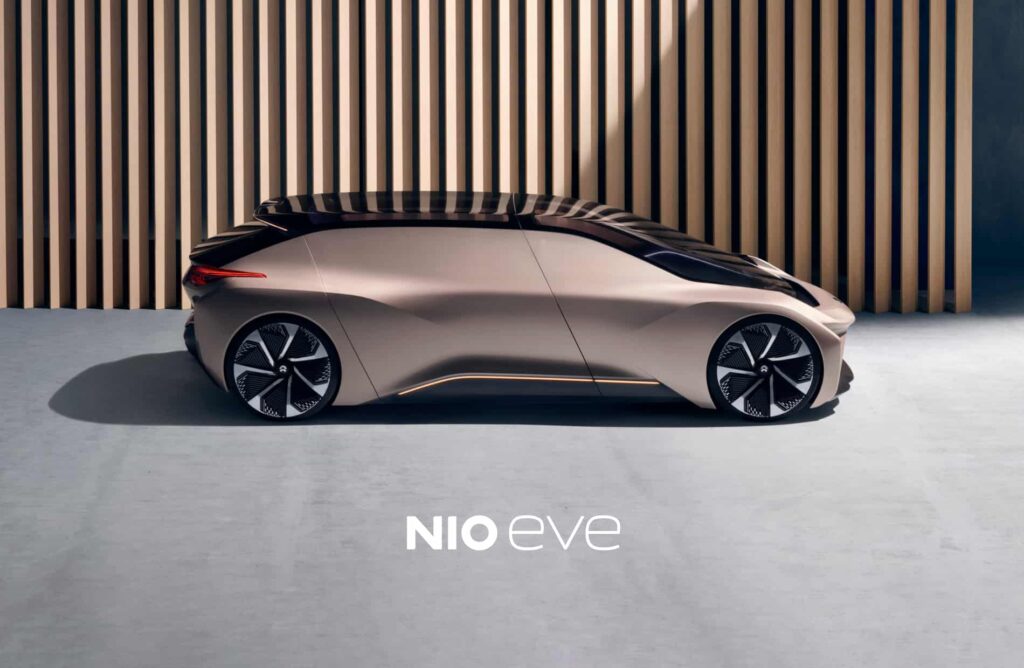

NIO: NMC and Battery Swap Models

NIO primarily uses high-energy-density NMC batteries from CATL but also offers LFP variants for certain models. NIO is also pioneering battery swapping technology, enabling fast, modular energy replenishment without plugging in.

Advantages of NIO’s Approach:

- High range with NMC chemistry

- Unique battery swap stations reduce downtime

- Customer flexibility through subscription battery plans

Why LFP and NMC Are Leading the Market

Most EV manufacturers rely on either LFP (Lithium Iron Phosphate) or NMC (Nickel Manganese Cobalt) chemistry. Here’s why:

- LFP: Safer, cheaper, longer life span, slightly lower energy density

- NMC: Higher energy density, better performance, but more expensive and less stable

These technologies strike a balance between affordability and range—two key decision factors for global EV adoption.

The uniqueness of NIO’s car brand batteries lies in the high energy density of NMC811 battery materials. NIO uses a battery material based on nickel manganese cobalt oxide (NMC811). This formula has a higher energy density, allowing the battery pack to store more power at the same weight and volume, significantly improving the endurance. For example, the battery packs of NIO’s ES8 and ES6 models are lightweight and have a high energy density, supporting long-distance driving.

NIO’s unique battery swap mode is its core competitive advantage. It can complete the fully automatic battery swap process within 3 minutes, which is faster than refueling traditional fuel vehicles, greatly solving the problem of slow charging of electric vehicles. Battery swap stations are spread across cities and highways, and users do not need to get off the car, making the battery swap process comfortable and convenient.

“Rechargeable, replaceable, and upgradeable” battery service system.

At the same time, liquid-cooled ultra-fast charging technology supports efficient charging and reduces user waiting time.

Global Trends in EV Battery Adoption

In 2025, the global EV market continues to diversify its battery sourcing. Developing nations prioritize cost-effective LFP options, while high-end markets push the limits with NMC and solid-state battery research. Regulations in Europe and North America are also influencing material sourcing and recycling standards. As the EV industry evolves, expect more regional customization in battery chemistry and design.

Conclusion

Whether it’s BYD’s ultra-safe Blade LFP or Tesla’s high-performance 4680 cells, manufacturers are optimizing for range, cost, safety, and infrastructure.

You need to consider the climate, charging time, and driving range when you are ready to replace your petrol car. We believe EV will take up more and more on the road, the clean and environment drive method will be good for our future. But it will happen all in a day, it will step in our life step by step until everyone accept it.